"It's just money; it's made up! Pieces of paper with pictures on it so we don't have to kill each other just to get something to eat!"

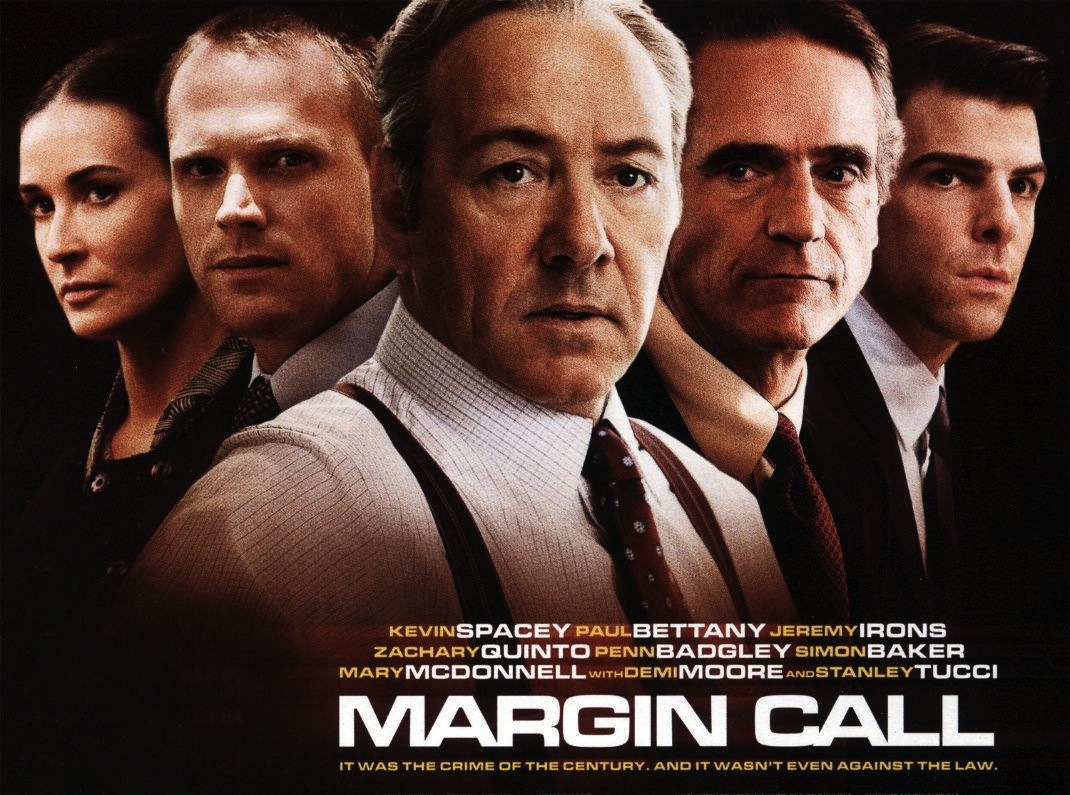

What is Margin Call really about? Other than the good actors, chilling background music and extraordinary views of New York City, Margin Call tells a story about the volatility of trading prices and how a fire sale (when a firm sells everything at discounted prices when they are faced with large risks) works. The movie is about how efficient the market is and how people reacted to the potential changes in the prices.

It all starts with an equation - an equation that proved that the company followed the historical trends. This means that their market is following Fama's (1970) weak form efficiency where the current price reflects all the past movements. Was this a wise decision? Personally, I think they should have followed Fama's strong form efficiency theory where they considered all the available information in the market. One of the issues for them was that the volatility trends showed everything going downhill for the company at any minute. They would be faced with a projected loss greater than its market capitalisation if the firm's assets decreased by just 25% but is this a risk that the company was willing to take? What would be the outcomes for them if they ignored this prediction and just kept going on with their business as normal? The company chose to not ignore the prediction and get out of the trading business as soon as possible.

"If you're the first out of the door, that's not called panicking!"

In the movie John Tuld claimed that the three ways to survive in the business was to be first, smarter or by cheating. The company's actions could be classified as being first or cheating. It is a matter of opinion. You could argue that they were the first to take actions in the market or it could be said that they were cheating because in the end, they were taking money off the people who did not know any better to save themselves in the crisis.

Their plan was to start selling as soon as the working day started but no employee was allowed to buy anything that day. Employees were promised a seven figure bonus as an incentive because some of them would have been reluctant to do this because they were putting their own careers at risk. The only issue was that they had to do this as quickly as possible. Once word got out, they were going to be making large amounts of losses - this is where they had to test the pricing efficiency in the market which is how quickly and rationally news in the market place is reacted to. This was a good theory for them to be using because as the day went on people started rejecting offers and the company was selling their assets at a much lower value than what it was worth - some of them making them a loss of millions of dollars. This was to be expected because different market participants got the news at different times of the day so they all reacted differently. For a market to be efficient, everyone would get the news at the same time but this was not the case.

A question left which is likely to be in everyone's mind after watching the movie is - "Do companies really work this way?" Surely insider information within the company can affect the way decisions are made - they may not always have the customers best interests at heart. A way to avoid this would be by considering Markowitz's portfolio theory and not investing everything you have with one firm.

Basically, do not put all your eggs into one basket! That's my opinion anyway, what's yours?

You Nailed it

ReplyDelete